utah food tax calculator

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. With our Utah tax calculator and state tax guide it can.

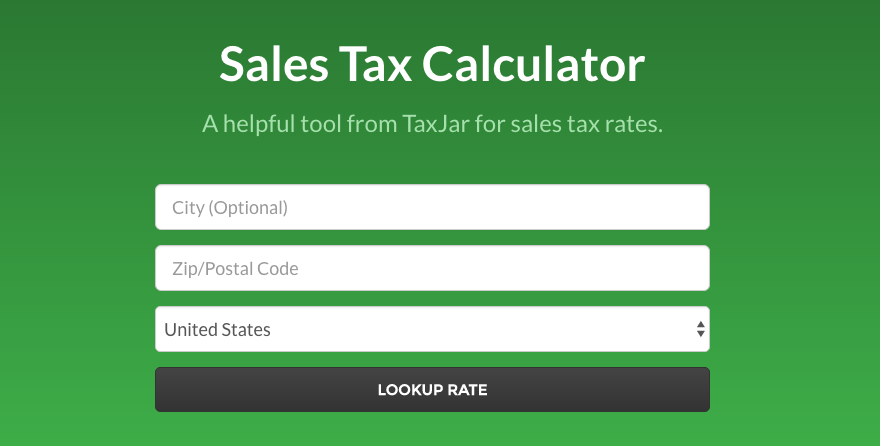

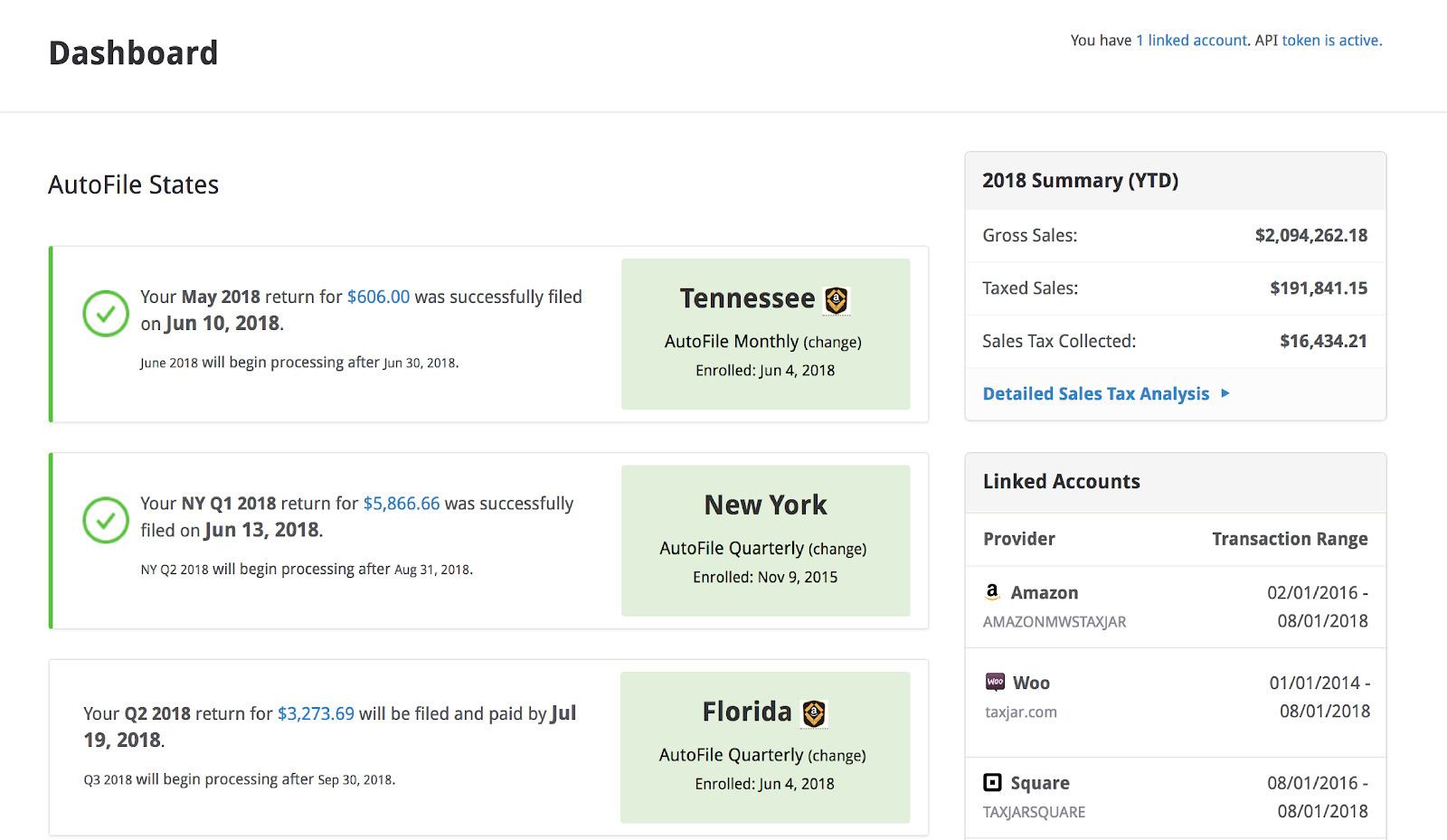

The Consumer S Guide To Sales Tax Taxjar Developers

In the state of Utah the foods are subject to local taxes.

. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. The restaurant tax applies to all food sales both prepared food and grocery food. Your average tax rate is 1198 and your marginal tax.

Use ADPs Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The state income tax rate in Utah is a flat rate of 495. In Texas prescription medicine and food seeds are exempt from taxation.

No state-level payroll tax. If you make 70000 a year living in the region of Utah USA you will be taxed 11852. Of your earnings being taxed as state tax calculation based on 2022 Utah State Tax Tables.

In other words those with an income higher. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. The median household income is 68358 2017.

And all states differ in their enforcement of sales tax. These items are grocery food so you collect tax at the grocery food rate 3 percent at checkout. This calculator has been updated to reflect federal guidelines that are effective October 1 2022.

This results in roughly of your earnings being taxed in total. To use the calculator just enter. Annual 2019 Tax Burden 75000yr income Income Tax.

Vermont has a 6 general sales tax but an additional 10. The Davis County sales tax rate is. However if we eliminate the sales tax on food the family with a taxable income of 25000 and who buys 300 of groceries a week would save 273 annually.

Also this calculator is intended to provide an ESTIMATE on what your benefits would be. The Utah tax calculator is updated for the 202122 tax year. Utah State Sales Tax.

While a state standard deduction does not exist a standard tax credit does exist and varies based on your filing status and income. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Utah Income Tax Brackets and Other Information.

The income tax is a flat rate of 495. Utah Income Tax Calculator 2021. And 09.

No cities in the Beehive State have local income taxes. Utah offers beautiful landscapes great food promising business opportunities and reputable colleges but at a more affordable cost. This standard tax credit phases out for high income earners.

Has impacted many state nexus laws and sales tax. Of course Utah taxpayers also have to pay federal income taxes. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax.

Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. - FICA Social Security and Medicare. Your actual benefits may end up being slightly more or less.

It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by retail. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Recipe Cost Calculator Spreadsheet Food Cost Spreadsheet Recipes All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier.

Back to Utah Sales Tax Handbook Top. Utah has a 485 statewide sales tax rate but also has 127 local tax jurisdictions including cities. Maximum Local Sales Tax.

Utah has a 485 statewide sales tax rate but also has 127 local tax jurisdictions including cities. Click here to apply for SNAP Benefits with the Utah DWS. To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Utah has a very simple income tax system with just a single flat rate. So the tax year 2022 will start from July 01 2021 to June 30 2022. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

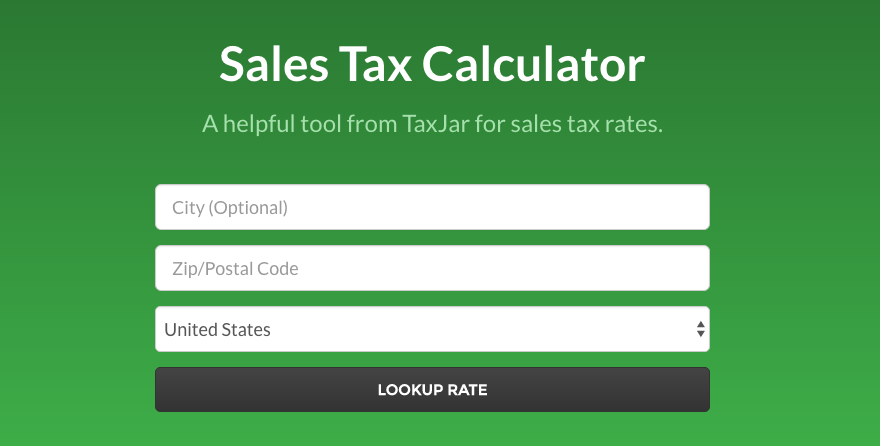

Both food and food ingredients will be taxed at a reduced rate of 175. Free calculator to find the sales tax amountrate before tax price and after-tax price. Overview of Utah Taxes.

You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. Important note on the salary paycheck calculator. Of that amount being taxed as federal tax.

The calculator on this page is provided through the ADP. Just enter the five-digit zip code of the location in which the. Report and pay this tax using form TC-62F Restaurant Tax Return.

Also check the sales tax rates in different states of the US. Average Local State Sales Tax. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Maximum Possible Sales Tax. - Utah State Tax. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Your actual benefits may end up being slightly more or less. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Utah Income Tax Calculator 2021.

Being taxed for FICA purposes. Utah tax year starts from July 01 the year before to June 30 the current year. No standard deductions and exemptions.

Used by the county that imposed the tax.

Self Employed Tax Calculator Business Tax Self Employment Employment

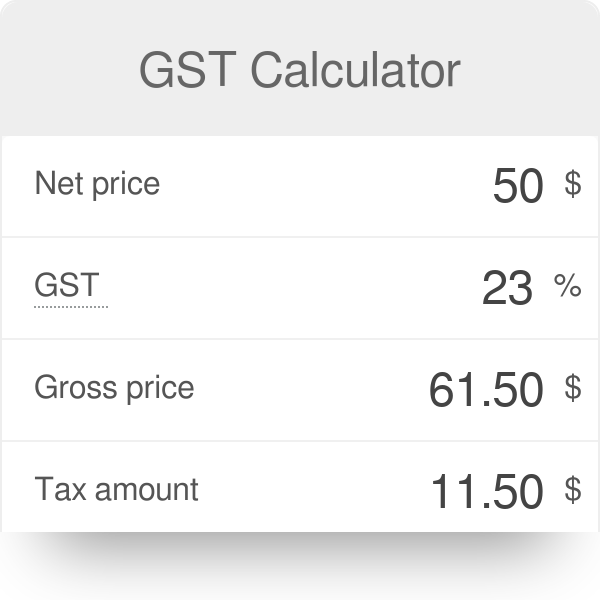

Calculate Sales Tax On Car Discount 59 Off Www Ingeniovirtual Com

Utah Sales Tax Small Business Guide Truic

Washington Income Tax Calculator Smartasset Com Travel Usa Seattle Ferry Travel

Income Tax Calculator 2021 2022 Estimate Return Refund

Gst Calculator How To Calculate Gst

California Tax Calculator Taxes 2022 Nerd Counter

Arizona Sales Reverse Sales Tax Calculator Dremployee

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

5 Tax Filing Tips Utah Coupon Deals

Woocommerce Sales Tax In The Us How To Automate Calculations

How To Charge Your Customers The Correct Sales Tax Rates

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking